How AI Agents Are Transforming Due Diligence in 2026

Intelligence DispatchesFebruary 14, 202610 min

How AI Agents Are Transforming Due Diligence in 2026

AI reduces DD review time by 70%. Here's exactly how multi-agent systems handle document analysis, risk scoring, and competitive mapping for institutional investors.

Due diligence is the backbone of investment decision-making. It's also one of the most time-consuming processes in finance — 8 to 15 hours per company for a basic assessment, 40+ hours for a deep dive. AI agents are compressing this timeline dramatically.

Thomson Reuters data shows AI reduces document review time by up to 70%. But this isn't about a chatbot summarizing a 10-K filing. It's about multi-agent systems that coordinate document analysis, financial modeling, competitive mapping, and risk scoring into a single orchestrated workflow.

Here's how it actually works.

The Old DD Process vs. AI-Assisted DD

The traditional due diligence workflow looks like this:

| Phase | Manual Time | What Happens |

|---|---|---|

| Document Collection | 2-4 hours | Gather 10-K, 10-Q, S-1, pitch deck, data room |

| Financial Review | 3-6 hours | Extract metrics, build comp tables, model revenue |

| Market Analysis | 2-4 hours | Size TAM/SAM/SOM, identify trends, validate claims |

| Competitive Mapping | 2-3 hours | Find competitors, assess positioning, evaluate moats |

| Risk Assessment | 1-2 hours | Identify red flags, regulatory exposure, team gaps |

| Report Writing | 2-4 hours | Compile into structured DD report |

| Total | 12-23 hours | Per company |

With AI agents, each phase runs through a specialized agent that handles the data-intensive work:

| Phase | AI-Assisted Time | What the Agent Does |

|---|---|---|

| Document Analysis | 15-30 min | Extract key metrics, risk factors, and claims from all documents simultaneously |

| Financial Modeling | 30-60 min | Build comp tables, calculate unit economics, generate valuation ranges |

| Market Research | 20-40 min | Web research for TAM data, trend validation, market sizing |

| Competitive Intel | 15-30 min | Systematic competitor identification and positioning analysis |

| Risk Scoring | 10-20 min | Quantitative risk matrix from structured factor analysis |

| Report Generation | 15-30 min | Compile structured DD report following institutional format |

| Total | 2-4 hours | Analyst oversight on validated AI output |

The analyst's role shifts from data gathering to quality control and judgment calls.

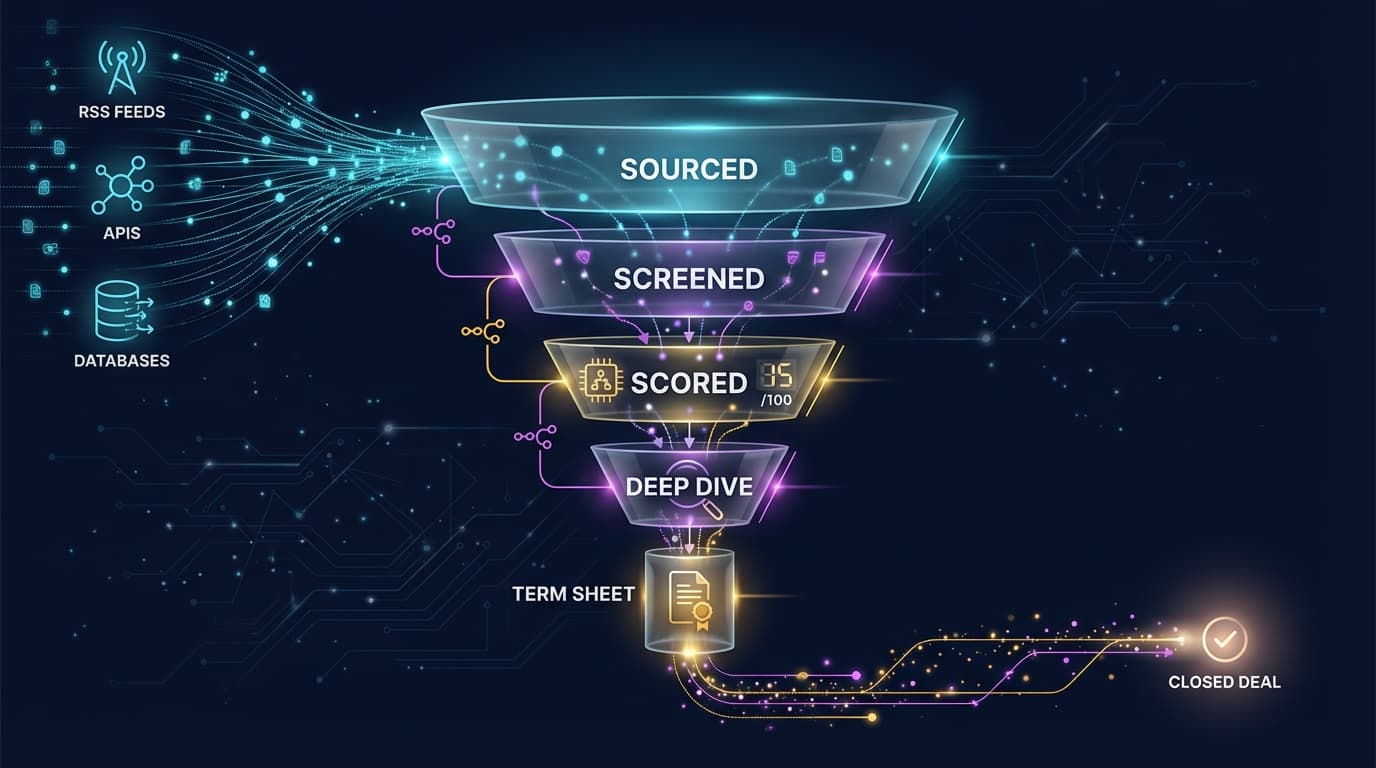

How Multi-Agent DD Systems Work

The most effective DD systems use specialized agents, not a single general-purpose AI:

Agent 1: Research Analyst

The first agent handles information gathering. It uses web search, document parsing, and financial database access to collect raw data. Every data point gets tagged with a source trust level:

- L1 (Highest): SEC filings, annual reports, audited financials

- L2 (High): Bloomberg, PitchBook, Crunchbase Pro

- L3 (Medium-High): McKinsey, Gartner, CB Insights reports

- L4 (Medium): WSJ, Financial Times, TechCrunch

- L5 (Low): Twitter, Reddit, LinkedIn (signal only)

This source hierarchy prevents a common AI failure mode: presenting unverified social media claims as fact.

Agent 2: Financial Modeler

Takes validated financial data and produces structured outputs: comparable company tables, unit economics summaries, and valuation ranges using multiple methodologies (DCF, trading comps, transaction comps).

The key advantage: consistency. Every company gets analyzed through the same framework, making portfolio-level comparisons meaningful.

Agent 3: Competitive Intelligence

Systematically identifies competitors through web research, maps their positioning across relevant dimensions, and evaluates competitive moats (network effects, switching costs, data advantages, IP).

Agent 4: Risk Analyst

Generates quantitative risk matrices from the combined research. Each risk factor gets scored by likelihood and impact, creating a severity grid that makes risk comparison systematic rather than narrative-based.

What Makes This Different From ChatGPT

Three things separate a real AI DD system from asking ChatGPT to "analyze this company":

1. Persistent Memory

Research context persists across sessions. When you analyzed Company A's market six months ago, that context is available when you look at Company B in the same sector. Research compounds over time.

2. Source Validation

Every claim gets traced back to its source with a trust level. L4-L5 data is never presented as fact. Contradictions between sources are flagged for analyst review.

3. Structured Output

DD reports follow a consistent 10-section format — not a wall of text. Scoring matrices, financial tables, and risk grids are structured data, not prose.

The 30-40 Hour Savings Per Deal

The Hedge Fund Journal reports that AI saves 30-40 hours on combined investment, operational, and legal due diligence. This breaks down roughly as:

- 15-20 hours saved on document review and data extraction

- 8-10 hours saved on market research and competitive analysis

- 5-8 hours saved on report compilation and formatting

- 2-4 hours saved on cross-referencing and validation

For a fund running 50 deals through screening per quarter, that's 1,500-2,000 hours recaptured — the equivalent of hiring a full analyst team.

Getting Started

If you want to set up AI-assisted DD for your investment process:

-

Start with document extraction — This is where the 70% time savings hits hardest. Even a basic setup that extracts key metrics from 10-K filings saves significant time.

-

Add source validation — Build the discipline of tagging every data point with its source and trust level. This is what separates useful AI research from hallucination-prone summaries.

-

Standardize your DD format — Define the exact sections, scoring criteria, and output format before configuring AI agents. The system is only as good as its framework.

-

Layer in competitive intelligence — Once your core DD pipeline works, add automated competitor mapping and market sizing.

For a complete system that includes skills, agent profiles, MCP server configuration, and multi-tool orchestration, see the IACOS (Investor Adaptive Creator OS) — a full investment research platform built on Claude Code.

What's Next

The trajectory is clear: from individual AI tools to integrated research platforms. Bain & Company reports 21% of M&A professionals already use generative AI in transactions. By 2027, the question won't be whether your fund uses AI for DD — it's whether your AI setup is competitive with everyone else's.

LPs are watching. Technology adoption is now a proxy for operational excellence, and LPs are explicitly asking about AI capabilities during fund due diligence.

The firms that build systematic AI research infrastructure now will compound that advantage over years. The ones that wait will be playing catch-up with increasingly sophisticated competitors.

For deeper research on AI in investment operations, see AI Investment Intelligence in the FrankX Research Hub.

Read on FrankX.AI — AI Architecture, Music & Creator Intelligence

Weekly Intelligence

Stay in the intelligence loop

Join 1,000+ creators and architects receiving weekly field notes on AI systems, production patterns, and builder strategy.

No spam. Unsubscribe anytime.